Part 1 of this series highlighted the issues, regulatory and supply chain complexities and efforts by industry to tighten the control of precious minerals sourcing. This is especially critical in developing nations, where human trafficking, regional conflict and lack of environmental laws and basic human rights are the rule rather than the exception. This post will look into a few examples of key manufacturers and efforts to date audit, validate and trace the precious minerals supply chain and what roles non-governmental organizations and we consumers have played so far in addressing this prickly issue.

“Conflict Areas” 101

The Organisation for Economic Co-operation and Development (OECD) issued a comprehensive guidance document in 2010 entitled Due Diligence Guidance for Responsible Supply Chains of Minerals From Conflict-Affected and High-Risk Areas. In this document, the OECD defined conflict-affected and high-risk areas as identified by the presence of armed conflict, widespread violence or other risks of harm to people.

“Armed conflict may take a variety of forms, such as a conflict of international or non-international character, which may involve two or more states, or may consist of wars of liberation, or insurgencies, civil wars, etc. High-risk areas may include areas of political instability or repression, institutional weakness, insecurity, collapse of civil infrastructure and widespread violence. Such areas are often characterised by widespread human rights abuses and violations of national or international law.”

Recent efforts by global industry associations and grassroots efforts by non-governmental organizations such as the Enough Project and its Raise Hope for Congo initiative have shed a good deal of light on a previously ignored issue. Unlike other countries, ore extraction in the Congo is both cheap and lucrative for the militias that control many of the artisanal mines. There has been widespread reporting about how child laborers are kidnapped from neighboring nations to work under forced conditions in the mines, (where miners often work for an average of $1 to $5 per day). An excellent article that describes the political and institutional issues that affect conflict affected areas, see the article Behind the Problem of Conflict Minerals in DR Congo: Governance by the International Crisis Group. This analysis places a lack of governance within the Congo squarely as a cause of the rampant growth of the conflict minerals trade and diversion of proceeds from sale to armed militias. Despite the “technical assistance” the author says the country receives from outside organizations, this “is not enough to compensate for the notorious lack of administrative capacity”.

Industry Under the Microscope

The intensity of recent news reports and discerning lack of detail in publicly reported data to date begs the question- have Intel and Apple really completely taken the “conflict” out their precious minerals sourcing, as recent headlines suggested? Or has their recent announcement been taken out of context and only another (positive) phase in their supply chain sourcing strategy. And if neither actually procures these materials from the Congo, are they merely shifting the issues to Asia?

Intel

To start answering these questions, I looked more deeply into the efforts to date by Intel to “get the DRC out” of the sustainable sourcing question. According to Suzanne Fallender of Intel on their corporate social responsibility blog, the company has made significant strides since 2009 to stay ahead of this issue. Specifically, according to Ms. Fallender (who I attempted to reach out to but had not yet returned my inquiries), Intel initiated a series of efforts in 2009 (prior to the CFS program), including:

- Posted its Conflict-Free Statement about metals on its Supplier Site

- Requested that its suppliers verify the sources of metals used in the products they sell us

- Increased the level of internal management review and oversight, as well as transparency and disclosure on this topic in this report

- Engaged with leading NGOs and other stakeholders to seek their input and recommendations.

- Hosted an industry working session at its offices in Chandler, Arizona in September 2009 with more than 30 representatives from mining companies, traders, smelters, purchasers, and users of tantalum to address the issue of conflict minerals from the DRC.

- Funded a study with EICC members on defining metals used in the supply chain, and continues working on a similar project to increase supply chain transparency for cobalt, tantalum, and tin.

Important to note is that Intel was the first company in the electronics supply chain to conduct on-site smelter reviews. Since the end of 2010, Intel has visited more than 30 smelters to assess if any of its suppliers were sourcing metal from conflict zones in the. According to Ted Jeffries, Director of Fab Services and Consumables at Intel (who I also attempted to reach for this article), he recently stated “I don’t know that we have a complete handle on the whole supply chain, but we at least have a better handle on the nuances”. Despite a letter campaign to its suppliers, Intel elected to visit each site and see for themselves to verify what was being self reported. “For the most part, for the Intel supply chain, the smelters that we’ve visited have been very truthful. There have been little caveats here and there, but for the most part, we can trace all of their sources to plants in Australia, South America and other parts of the world,” Jeffries said at the Strategic Metals for National Security and Clean Energy Conference in Washington D.C. in mid March.

“It really takes someone stepping up to the plate and taking a leadership role and taking a risk on a strategy. We can sit around and debate these things until the cows come home and nothing will change. At the end of the day, if we want to move forward on this debate, someone needs to make a strategic decision and start moving in that direction”. -Ted Jeffries (Intel)

Apple and Hewlett-Packard

As I’ve reported in Part 1 of this series, the multitude of supply chain layers and sourcing channels developed over the years may be a difficult weave to untangle (often 5-10 layers between the mine and the end product). Take Apple, who (according to its recently released 2011 Supplier Responsibility Progress report ) has 142 suppliers using tin; these suppliers source from 109 smelters around the world. As a key participant in the EICC/GeSi CFS initiative, smelter audits are in process. Additional efforts to contact Apple supply chain and sustainable sourcing staff have been unanswered. Unlike Apples sub-par sustainability efforts with its Chinese electronics supply chain, it’s heartening that the company is taking some leading action in this area.

Hewlett-Packard says, “[T]hese issues are far removed from HP, typically five or more tiers from our direct suppliers.” But they have gone a long way in developing an aggressive auditing, tracking and reporting mechanism. HP and Intel have published the names of their leading suppliers for the 3T metals, as well as some smelters. On April 8th, HP issued its revised Supply Chain Social and Environmental Responsibility Policy as part of list supplier compliance program (which HP began developing ten years ago). HP’s suppliers are expected to “ensure that parts and products supplied to HP are DRC conflict-free”. Moreover suppliers are to establish policies, due diligence frameworks, and management systems, consistent with the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas.

Confronting Our Electronics Addiction

“I’m a Mac and I’ve got a Dirty Little Secret”. That was the title of parody of the Apple ad campaign, issued last year by the Enough Project. While the video took a soft-handed approach to helping consumers make a visceral connection with conflict minerals, it also suggested that consumers’ purchasing power can influence corporate sourcing behaviors…and they can.

Last year, Newsweek magazine looked at this issue square in the eye. The article stated “It takes a lot to snap people out of apathy about Africa’s problems. But in the wake of Live Aid and Save Darfur, a new cause stands on the cusp of going mainstream. It’s the push to make major electronics companies (manufacturers of cell phones, laptops, portable music players, and cameras) disclose whether they use “conflict minerals… Congo raises especially disturbing issues for famous tech brand names that fancy themselves responsible corporate citizens. As Newsweek also reported, the Enough Project and its allies “believe awareness drives better policy. So as we lovingly thumb our latest high-tech device, perhaps some self-reflection: after all, the final point in the supply chain is us.”

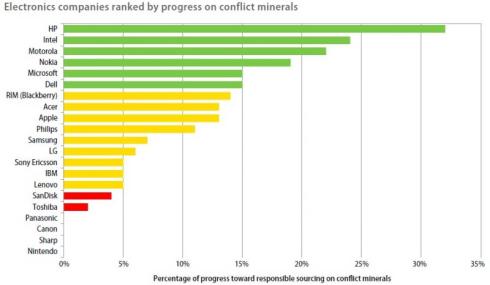

As an effort to raise consumer awareness of efforts that companies are (or are not) taking, the Enough Project[1] surveyed the 21 largest electronics companies to characterize progress made toward establishing documented and verifiable conflict-free supply chains in Congo. The project ranked electronics companies in and four other product sectors on actions in five categories that have significant impact on the conflict minerals trade: tracing, auditing, certification, legislative support, and stakeholder engagement. Four levels of progress (ranging from Gold Star to Red) were established based on efforts to date and suggestions to shore up perceived weaknesses. The user-friendly ranking can be used by consumers to support purchasing decisions and offers a way to get in contact with each company to communicate calls to action.

Enough Projects analysis (as shown in the graphic) indicates that six electronics companies are leading industry efforts to address conflict minerals, while two-thirds of the appeared to be taking limited action. This graph also suggests that the bottom -third are way behind the industry curve.

Enough Projects analysis (as shown in the graphic) indicates that six electronics companies are leading industry efforts to address conflict minerals, while two-thirds of the appeared to be taking limited action. This graph also suggests that the bottom -third are way behind the industry curve.

Meanwhile, the auto, jewelry, industrial machinery, medical devices, and aerospace industries are well behind the electronics sector and only now beginning to address the role that conflict minerals may play their respective supply chains. I’ll be watching with interest what the Automotive Industry Action Group does. So the opportunity for direct end-consumer advocacy to influence corporate social responsibility in sourcing is bountiful.

Evidently, the biggest challenges to grabbing the conflict minerals issue by the reins is in untangling the convoluted supplier network, building a robust product traceability and independent verification process, and enacting sound policy that drives accountability and transparency among all stakeholders. Not an easy task, but compared to years past, a vast improvement for sure. The final part of this series will highlight specific international guidance and steps that industries and consumers can continue taking (while we wait for the SEC rules to get finalized) to proactively address supply chain minerals sourcing and maintain a high level of corporate social responsibility.

[1] The Enough Projects focus is on conducting field research, consumer and issues advocacy, and communications to support a grassroots consumer movement.

Recent Comments